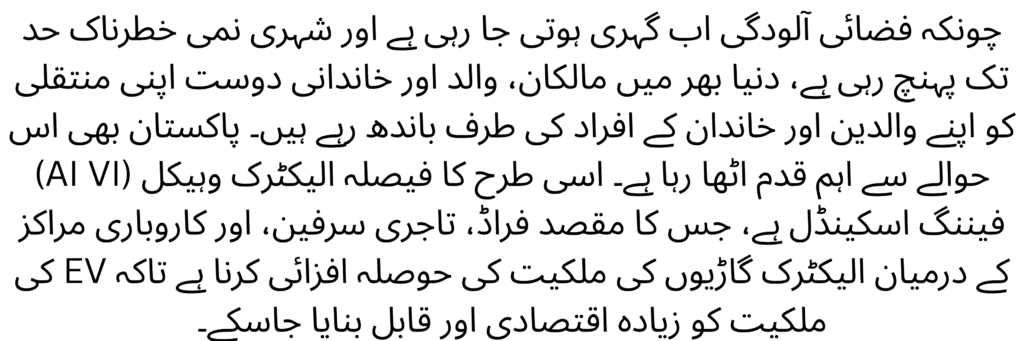

As the air pollution is getting deeper now and urban humidity is reaching a dangerous level, owners, fathers and family friends across the world are tying their transfer towards their parents and family members. Pakistan is also taking an important step in this regard. A similar decision is the electric vehicle (AI VI) fanning scam, whose aim is to encourage the ownership of electric vehicles among the fraud, Tajari Surfin, and business centers so that the ownership of EV is made more economical and capable.

Pakistan’s Electric Vehicle Policy 2020-2025 was launched under the same vision, this fanning scam is a mastermind behind the State Bank of Pakistan (SBP), commercial banks, and other such minofecturers and dealers. This organization presents low-cost loans, intentions of easy achievement and self-interest for the purpose of clearing the nails and activities of the government and for doing the work of the owner on the living world.In this detail, we are going to discuss the features, eligibility criteria, related documents, benefits, challenges, and travel related vision of this VI fanning scam 2025.

Also read : Govt rejects banks’ demand for higher interest on EV financing for two- and three-wheelers

Key Features of the EV Financing Scheme for EV Financing Scheme 2025

The EV Financing Scheme offers a wide range of attractive features that make electric vehicle ownership easier than ever:

🚘 1. Fans of different types of vehicles for EV Financing Scheme 2025

🛵 Two wheeler vehicles (either bike or scooter)

🛺 Two wheeler (carriage)

🚗 Four wheeler vehicles (carriage, scooter, etc.)

🚚 Light commercial vehicles (LCVs)

💸 2. Affordable Markup Rate for EV Financing Scheme 2025

📉 Mark, your income is limited to 6% annually, which is less than the regular auto loans.

🤝 Along with the glass bink minifectures, we also offer interest tax for the bike through self-employment.

⏳ 3. Flexible Tenure for EV Financing Scheme 2025

Funding is available for 7 years.

Towel payment helps reduce the burden and provides relief in movement.

🏦 4. Minimal Down Payment for EV Financing Scheme 2025

The cost of the lower accommodation is less than 15-20% of the cost of the vehicle.

In most cases, the subsidy on the cost of all the vehicles reduces significantly due to the cost of the vehicles.

🔋 5. Inclusive for Individuals and Businesses for EV Financing Scheme 2025

There is a great deal of fear for horse-driven trains, logistics companies, educational institutions, and delivery companies.

There is a great deal of fear for women, food, and labor.

Eligibility Criteria for EV Financing Scheme 2025

To qualify for the EV Financing Scheme, applicants must meet the following basic criteria:

Details of the limit

The age of loan is 21 to 65 years

The average age of a Pakistani city is CNIC.

The income is transferred through transfer of income, own property, or business income

There is no problem of credit record and loan without any liability.

The account with the account share line of the bank account can be cancelled due to the payment of loan amount.

Required Documents for EV Financing Scheme 2025

Here is a list of documents typically required when applying for the EV financing scheme:

For Salaried Individuals:

Darist CNIC to Capi

Fresh Dancing Salps (Pachale 3 months)

Bink Statement (6 months)

the elephant of truth

sis passport to approve.

For Business Owners/Self-Employed:

Paper copy

Income tax and tax return documents

Bank statement (12 months)

Business registration documents

Proof of income (salary, salary, etc.)

For Students:

A Form or B-Form (with A Form of Caretaker)

Proof of income of the garden

Identity card of the Talab Alam

Bank account details of Caretaker

Also read : Punjab Roshan Gharana Solar Panel Scheme 2025 – Free Solar Systems for 50,000 Low-Income HomesApplication Process for EV Financing Scheme 2025

Applying for the EV Financing Scheme is simple and can be done both online and in-person at participating banks.

📝 Step 1: Research & Select Vehicle

SBP is a marketing tool that can improve your productivity and reduce your risk of heart disease.

Taxation, battery life, or even worse, it can be fatal to your child

🏦 Step 2: Approach a Participating Bank

Visit any Majaz bink (HBL, Meezan, UBL, MCB, bink alfilah, etc.)

If you are interested then please provide me with a description about your status.

📤 Step 3: Submit Loan Application

Complete the application form.

Submit all the required documents for income verification and booking of the vehicle.

📊 Step 4: Loan Assessment

bink Your credit history justifies hasty behaviour, advising on admissibility, and delay in paying in the dark.

After approval, the loan arrangement and EMI schedule are prepared.

🚗 Step 5: Vehicle Delivery

Once the down payment is made and the loan is paid, the vehicle is delivered.

The registration, endorsements, and tracking number are handled through dealership on the vehicle.

Benefits of the EV Financing Scheme for EV Financing Scheme 2025

🌱 1. Advantages

The consumption of zero oil pipes is better than the city air.

It reduces the pollution of Pakistan’s carbon deposits and expensive oil.

💰 2. Saving of cost

Charging an EV is 70-80% cheaper than charging petrol or a similar vehicle in the evening.

It is better to consume less oil due to less fuel and use of oil.

⚡ 3. The efficiency of the oil refinery

Actor’s vehicles replace more than 85 percent of the oil refinery in an instant.

Use of Shamsi or Gard Bajli for daily travel.

👷 4. Employment and Sanitary Tariff

It increases the local temperature, charging station temperature, and battery supply.

It produces vegetable oil in the evenings of sales, sarees and cleaning.

🚀 5. Government tax

Issuance of registration fee, token tax, or penalty duty (for CKD units).

In some urban centers, there is provision of parking space for EVs.

Challenges & Areas for Improvement

Despite its promise, the EV Financing Scheme faces a few roadblocks:

⚠️ 1. Muhadud charging infrastructure

There are currently less than 200 public charging stations in Pakistan.

Fast charging stations are located in urban areas on a daily basis.

💡 2. Other pet food items

While there is help from the carzone, but due to the cost of the stamp, the cost of the vehicle is more expensive than the passenger vehicles.

The cost of battery replacement is still a possibility even after 6-8 years.

🛠 3. Lack of technical machinists during the repair

The old workshops and machines are also very expensive.

The technical repair industries need initial scaling.

🔌 4. Blocking of electricity and load of the yard

The repeated blocking of electricity in many places makes the EV charging difficult.

There is a danger of overloading the yard during short periods without load adjustment.

Government’s Long-Term Vision

The government plans to accelerate EV adoption by 2030 with the following goals:

Target goal

30% share of EV in mass vehicles by 2030

30% share of EV in vehicles and trucks by 2030

50% share of EV in motor cycles and vehicles by 2030

Local EV generation, localisation of EV houses and utilities is a must

Charging infrastructure should launch 3,000+ public AI chargers.

Conclusion

However, the answer to the success of this scam is to increase the basic wealth, improve public trading and make the technical preparation reliable. If implemented properly, this decision can wipe out the name of Pakistan’s nails and Hamil’s image in a new way for the coming generations.

🔹 Q1: What is the EV Financing Scheme 2025 in Pakistan?

Answer: The EV Financing Scheme 2025 is a government-backed initiative that allows individuals and businesses in Pakistan to purchase electric vehicles through low-interest bank loans. It covers e-bikes, cars, rickshaws, and light commercial EVs with markup rates as low as 6%.

🔹 Q2: Who is eligible to apply for an electric vehicle loan in Pakistan?

Answer: Pakistani citizens aged 21 to 65 with a valid CNIC, a stable income source (salaried, self-employed, or business), and a clean credit history are eligible to apply. Students and women are also encouraged to apply under special categories.

🔹 Q3: Which banks are offering EV loans under this scheme in 2025?

Answer: Major banks such as HBL, Meezan Bank, UBL, MCB, and Bank Alfalah are offering electric vehicle loans under the State Bank of Pakistan’s EV Financing Scheme 2025. Each bank may have slightly different terms and application procedures.

🔹 Q4: What types of electric vehicles are covered under this scheme?

Answer: The interest or markup rate is capped at 6% per annum. Some banks may offer even lower or zero-interest loans for specific categories like e-bikes or students, depending on partnerships or subsidies.

🔹 Q5: What is the interest rate for electric vehicle loans in Pakistan?

Answer: The interest or markup rate is capped at 6% per annum. Some banks may offer even lower or zero-interest loans for specific categories like e-bikes or students, depending on partnerships or subsidies.